how do business loans work in south africa

An SME in South Africa is. Bi monthly it would be of R 983333.

Business Loan Application Getting A Business Loan In South Africa Lulalend

Monthly repayment would be of R 1966667.

. Monthly repayment would be of R 1966667. Ad Up to 500000 in 24 Hours For All Credit Levels Based On Cash Flow. The coronavirus loan scheme for businesses has been collectively developed by.

Choose Easily Start Regrow Your Business. Bi monthly it would be of R 983333. Small businesses in South Africa can access up to R1 million for procurement.

The loan calculator provided by Fundrr enables clients to grasp a. Your credit score is an indicator of your chance of default. 10000 Monthly Deposits Into Business Bank Account.

Ad Free Online Offer Lowest Rates FastEasy Approval No Credit Score Effect. Ad 7 Billion Already Delivered. An alternative way to get business loans in South Africa.

Funding From 25K-500K In As Little As 24 Hours. Ad Business Loans Made Simple. COVID-19 Business Loans in South Africa Applying for Business Funding in South Africa.

Per week it would be of R 454196. Focusing on how loans operate in Southern Africa is key for each business and entrepreneur owner in the united states. The higher the score the less risk your business poses to a lender.

But what is a credit score and how does it work in South Africa. The loan calculator provided by Fundrr enables clients to grasp a better understanding of the workings. Experience Fast Easy Hassle-Free Funding Process Get Funded As fast As 72 Hours.

QuickBridge We Say Yes When Others Say No. In south africa this type of loan tends to be available for up to 75 of a commercial propertys valuation but the exact figure varies from provider to provider. Helped 225000 Small Businesses since 2007.

Below are two key ways to increase your chances of qualifying for the business funding you need to. There are several types of private financing. Wikipedia defines a small business as.

Private loans are often easier to qualify for than traditional loans but can also have less favorable terms and in some cases higher interest rates. Bright Capital gives three types of business loans Invoice Finance and Purchase Order. Top Rated Business Funding Options.

Many companies will require some kind of a credit or. Yes many agencies and banks once again offer loans in South Africa for all kinds of terms. Getting a business loan in South Africa is easier when you are prepared.

The Small Business Administration offers loans for people who are starting or operating small businesses. Bridgement offers an alternative solution for a business owner needing to apply for a business loan in South Africa. If you need a loan for six months in term Nedbank and Standard Bank are great options to take.

How Do Business Loans Work In South Africa 2020

Business Loan Fixed Repayments Standard Bank

7 Best Small Business Loan Lenders In South Africa

How Do Business Loans Work In South Africa 2020

Best Small Business Loans For Veterans Of October 2022 Nerdwallet

Best Small Business Loans For Women Of October 2022 Nerdwallet

8 Ways To Get Money To Start A Small Business

Fund4biz Business Funding Small Business Loans Personal Loans South Africa

Scaling Small Business Lending In West Africa

Lendio Your One Stop Shop For Business Finances

In South Africa More People Have Loans Than Jobs The Economist

How Does Mortgage Interest Work Rocket Mortgage

South African Smes Post Covid 19 Mckinsey

An Analysis Of Financial Institutions In Black Majority Communities Black Borrowers And Depositors Face Considerable Challenges In Accessing Banking Services

Quick And Safe Start Up Business Loans In South Africa October 2022

5 Best Small Business Funding Resources In South Africa 2022 Briefly Co Za

South African Smes Post Covid 19 Mckinsey

R200 Billion Covid 19 Smme Loan Scheme

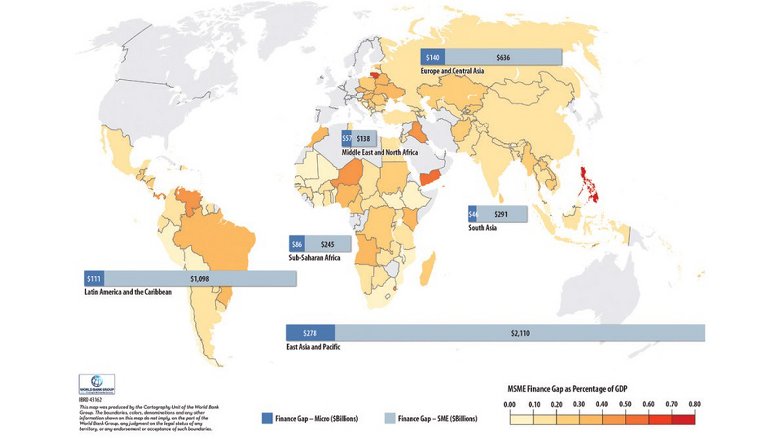

World Bank Sme Finance Development News Research Data World Bank